Important Notes:

-

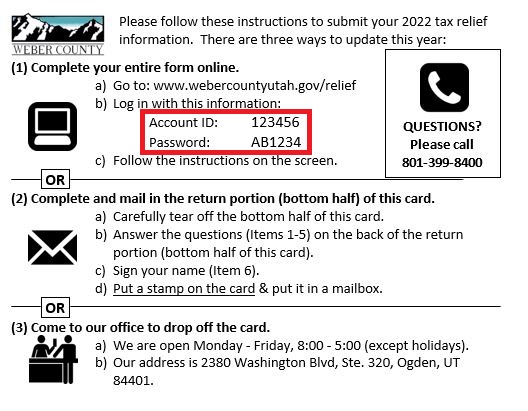

You can find the account ID number and Password on the post card that was mailed to you.

For Example:

- This is for the Disabled Veteran tax relief program only. If you receive benefits from the Circuit Breaker, Blind, or Abatement programs as well, you will need to submit a paper form to our office.

- We need to confirm your information each year by September 1st to ensure you still qualify for the tax relief program and your details have not changed. Please submit any changed or updated documents to us as soon as possible, and no later than September 1st.

- For tax relief amounts to show on your Tax Notice, confirm this information before September 1st.

- For exemption on personal property (cars, trailers, etc.) please contact our office.

- Not your record? Check your Abatement ID and try logging in again or call the Clerk/Auditor's Office at 801-399-8489.

- If you have any questions, please contact the Clerk/Auditor's Office at 801-399-8489.